MyTax Illinois

Illinois offers state taxpayers who give through the Community Foundation generous income tax incentives to make it easier for you to give more for less. Before beginning the process of securing an Illinois Gives endowment tax credit, you must have a MyTax Illinois account. If you have already done so, please move to Step 1.

To create a MyTax Illinois account, go to MyTax.Illinois.gov and click the Sign Up link.

Click NEXT

In the “Individuals” box click on “Request a Letter ID.” From there it will ask for some personal information about you, and then you submit. The state will then mail you a letter containing your personal Letter ID. Once you have the letter, then you will go back into MyTax.Illinois.gov and complete registration for an account with the Letter ID provided.

After you have set up your account, continue to Step 1 to apply for a Contribution Authorization Certificate.

Step-by-step donor instructions

Step 1

Once you have established your MyTax Illinois login, go to MyTax.Illinois.gov and enter your credentials in the top-right hand login box.

Step 2

Once logged in, click “View more account options” in the “Individual Income Tax” section of the Summary page.

step 3

Click “Contribute to Illinois Gives” under the “Account Options” box.

Step 4

Click “Next.”

Step 5

Now you are at a form to submit your gift details. Enter the gift information and from the drop-down menu, select “QUAD CITIES COMMUNITY FOUNDATION.” Once the gift information is entered, click “Submit.”

IMPORTANT NOTE: Once you register a gift through MyTax Illinois, your gift must be received and processed by the Quad Cities Community Foundation within 10 business days in order to be eligible for a credit. If you make your gift to the Community Foundation prior to registering the gift in MyTax Illinois, you have 10 business days to register your gift in MyTax Illinois for it to be eligible for a credit. If you are registering for a gift of stock or other marketable securities, please contact our Development Team prior to submitting your gift details, to ensure the correct gift valuation is entered as it differs from the federal deductibility valuation.

Step 6

A confirmation box will appear after you submit the gift information.Re-enter your MyTax Illinois password and then click “OK.”

Step 7

If you have not already done so, you may now move forward with making your gift as described in your Illinois Gives application. You have 10 business days to do so for your application to be valid. In addition, it is requested that you let a member of the Community Foundation development team know of your Illinois Gives application and pending gift.

Step 8

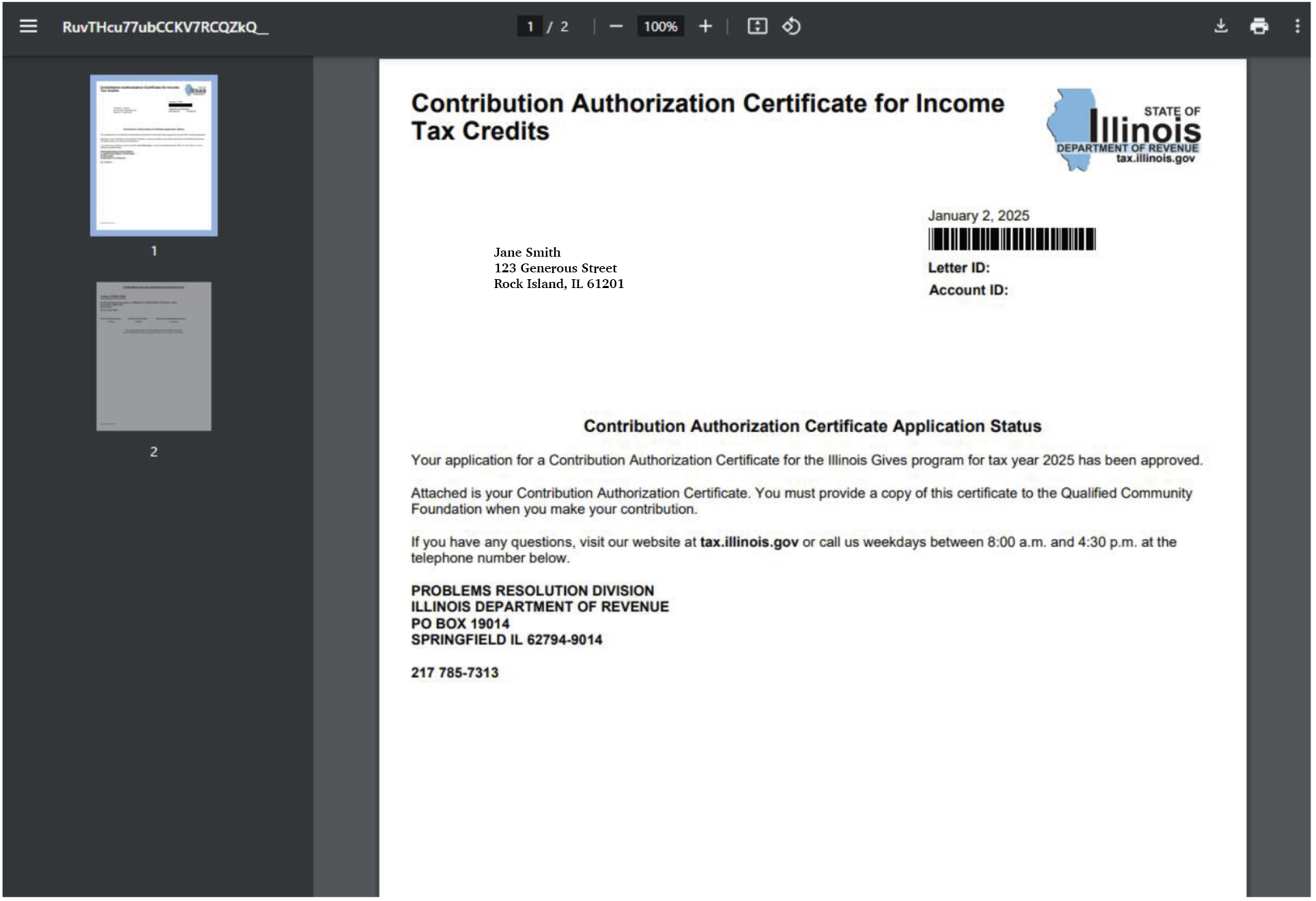

After you have made your gift, the Community Foundation will confirm it through MyTax Illinois and notify you. Once confirmed, you can view your Contribution Authorization Certificate for Income Tax Credits by logging into MyTax Illinois and clicking “More…” on your summary page.

Step 9

In the “Letters” box, select “View Letters.”

Step 10

Once the gift has been authorized by the Illinois Department of Revenue, you will see a “Contribution Authorization Certificate for income Tax Credits” you can download and submit with your Illinois taxes for the tax year indicated.